Know what’s out there.

The risks associated with daily transactions continue to pile up, with new and more dangerous threats to our personal information, financial accounts, and digital identity being implemented every day. The World Wide Web may have brought the far reaches of the world to our fingertips, but it’s also given criminals new means to identify, target and defraud their victims. Even physical retail locations are not immune to digital scams, with almost daily stories appearing on Nextdoor about ATM and credit card information stolen by skimmers or RF-ID readers.

The reality is that scammers and hackers can likely reach you from anywhere, and these crimes are becoming so commonplace that for many, the odds of being targeted are high. I recently read on USA Today™, about folks being scammed out of hundreds of thousands of dollars by fraudsters from Mexico who are posing as buyers for their timeshares. They interviewed one victim who lost nearly $1.8 million. (Read the full article here.) While we may laugh when we receive an email about an inheritance from a long lost relative or an African Prince in need of our help, the truth is these scams wouldn’t persist if they didn’t find their mark. And often, just when we identify one scam, three new scams take their place.

If you watched John Oliver’s “Last Week Tonight” episode that aired Sunday, February 25th, you may recall his main story was about a massive global scam called “Pig Butchering” which is catching even very savvy folks off guard. Scams like this can involve large criminal operations which go to great lengths to convince you of their legitimacy.

Even beyond telemarketing scams, your data is likely out there, which means it’s vulnerable to attack. We’ve all seen stories about hackers getting into government computers (Oakland last year), financial institutions (ICBC, the world’s largest bank ), casinos (MGM ) and many others. 2023 was a big year when it came to these kinds of hacks. Many of us have gotten notice from one or more companies that our information may have been compromised, I know I have. If these big businesses and entities can’t keep them out, how much of a chance do you and I have against them?

If they can’t be stopped, at least slow them down.

There are no foolproof ways to protect yourself from identity theft or being hacked. That said, these folks are looking for easy marks, so if you can make things harder for them, they are likely to look for an easier ‘target’ instead. Here are 5 things you can do to prevent significant damage to your credit, assets or identity:

- Stop using your ATM debit card. Since it is linked to your bank accounts, scammers try to get your money and if they are successful you’ll likely have to fight to dispute the charges and get your money back. If you use a credit card, you are using the bank’s money and they have an incentive to get their money back, reducing the potential disruption to your personal finances. Even using your debit card at the Bank ATM can be risky. Card readers are getting harder to detect and are even being found in ATM’s outside of banks. Go inside to use the ATM, it’s really your best defense.

- Emails are dangerous. Every day I get messages in my inbox asking me to login, verify my information or open an attachment. These emails often look real and appear to come from legitimate institutions like banks, businesses or governmental agencies. Always double-check the email address; small changes or errors in the IP can often indicate a fraudulent sender. If it looks real, verify by calling the institution in question directly, but be sure to look up the number yourself. Some scams set up their own answering services and provide fake phone numbers to seem legitimate.

- This goes for personal emails as well. I have had both friends and clients have their emails hijacked. Even if the message is from a sender you recognize, if the contents seem off, it could be someone has hacked into their account. I would urge you to call that person to confirm that they sent the email.

- Change up passwords. It is so tempting to use a single password over and over again, so it is easier to remember. While it can be inconvenient to create and remember different passwords for different sites, try to keep in mind these passwords exist for our own protection. Rather than reusing passwords, consider getting a password manager, to maintain your security while reducing the reliance on remembering everything yourself.

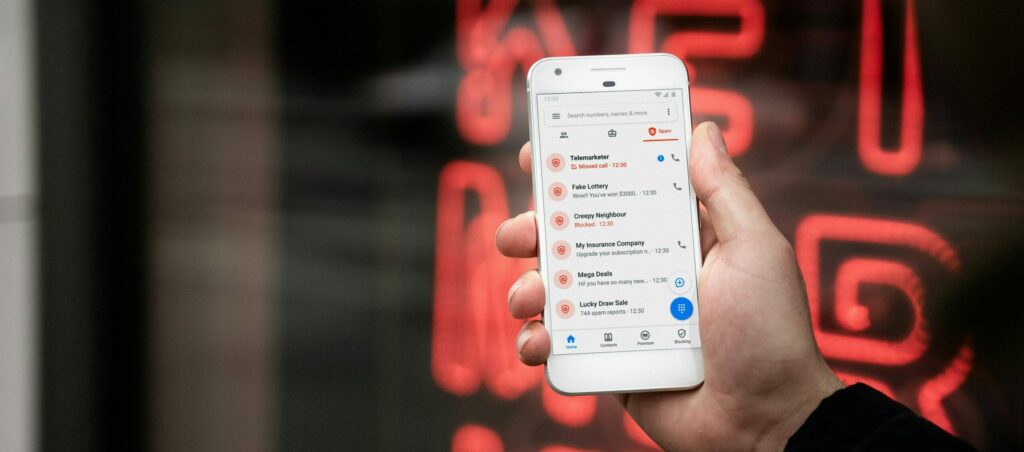

- Phones can be more vulnerable. According to a recent article on the “Security Investigation” website, mobiles are just as vulnerable to security concerns like viruses or malware as PCs. (Read the full article here.) Be sure to password protect your phone, keep the operating system up to date and check the privacy settings on your apps. System updates and patch releases often include important security fixes and new protections for your device. Even if you download all your apps from trusted sources. Many apps request access to personal information they may not need to operate. Controlling what information apps have access to can help protect your sensitive information if that app is ever hacked or compromised.

Our modern technology has made many things more convenient and accessible. The cost of that convenience is that we may all be more vulnerable to being the victim of these types of crimes. Generally, there are few ways to retrieve our assets once they’ve been exposed, we should take action to protect ourselves from these types of attack. Many of us know someone whose information has been compromised and the repercussions of that breach. Whether the costs are financial, personal or both, getting back to normal, can be time consuming and frustrating, if it is even achievable. It’s worth the time and effort to make sure you’re being safe out there and avoid the inconvenience, headache and loss altogether.

If you would like to discuss ways to protect yourself, I am happy to have that discussion.